The Complete Private Lending Platform

Powering every stage of your private lending journey — from lead origination to investor onboarding, settlement, and beyond.

25+

Years Combined Experience

100M+

Assets under management

120+

Active Investors

Revolutionizing Private Lending

Monergise is built by Australian private lenders for private lenders. We offer a comprehensive end-to-end platform to manage your mortgage-backed lending operations seamlessly, improve investor relations, and maximize deal success.

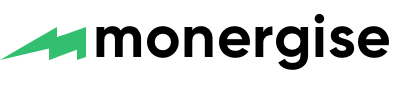

With Monergise, you can automate deal origination, streamline KYC for individuals and entities, generate automated investor and discharge statements, and securely manage documents using our digital data rooms—all under your brand with white-label solutions.

Monergise Process

Automate every stage of your loan journey

Monergise streamlines every stage of your lending cycle—from lead generation to final settlement—ensuring compliance, efficiency, and growth.

Whether you’re managing one deal or a complex portfolio with multiple investors, our end-to-end platform simplifies workflows, automates compliance, and elevates your investor experience—all under your own brand.

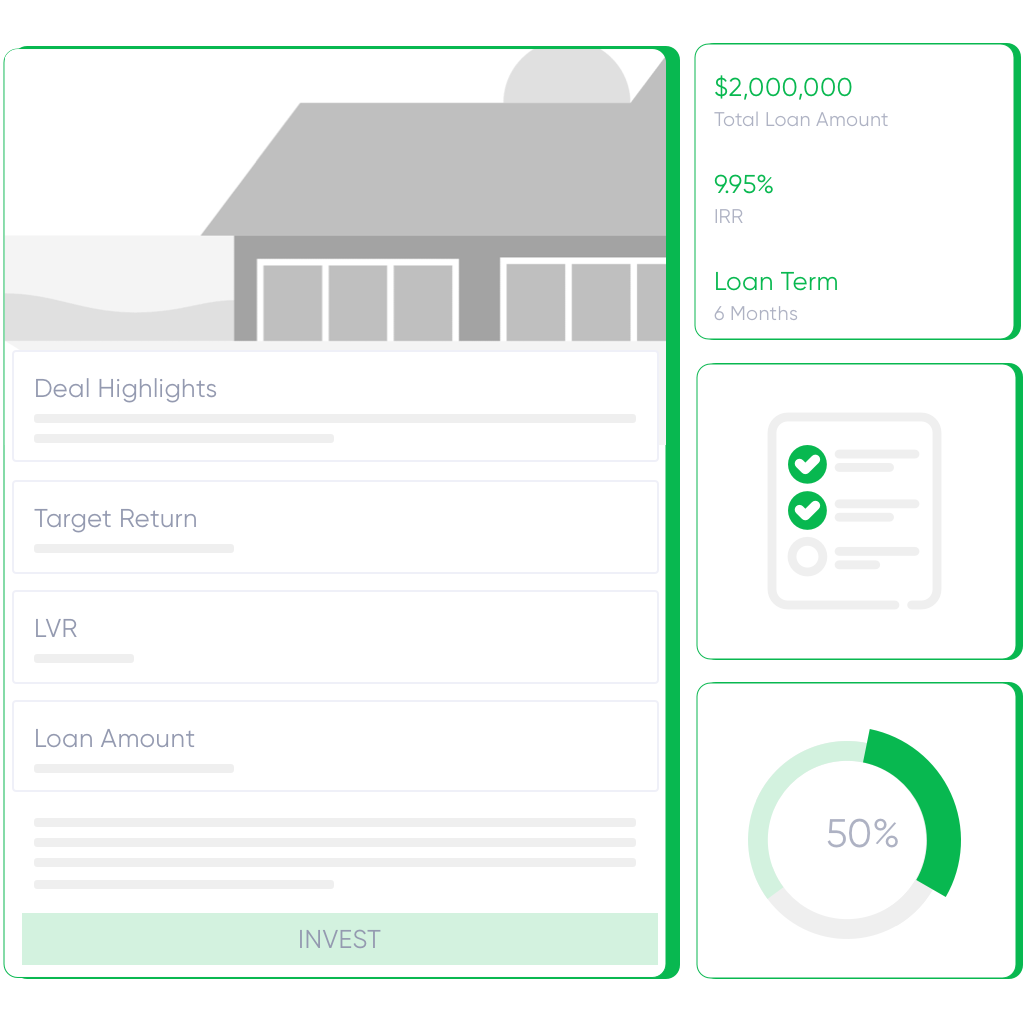

Lead Origination & Analysis

Quickly generate deals with our smart calculators and loan summary tools. Assess viability and structure loans confidently using dynamic insights.

Investor Onboarding & KYC

Onboard investors with seamless digital forms and built-in KYC for Individuals, Companies, and Trusts—fully compliant and secure.

Automated Documentation

Generate investor statements, discharge statements, credit sheets, and deal teasers automatically. Save time and reduce manual errors.

Real-Time Monitoring

Track deal progress, monitor investor activity, and stay on top of key milestones using our intuitive dashboards and automated reminders.

Settlement & Reporting

Seamlessly manage final settlements and deliver automated reports to investors, ensuring transparency and trust throughout the lifecycle.

Services

Deal Origination & Automation

Accelerate deal generation with our built-in smart calculators and automated loan summaries, ensuring faster approvals and structured deals.

- Smart Loan Calculators

- Automated Deal Summaries

- Fast Deal Structuring

Investor Onboarding & KYC

Streamline investor onboarding with integrated KYC compliance for Individuals, Companies, and Trusts—all managed digitally.

- Digital KYC for All Entities

- Compliance Automation

- Investor Management Dashboard

Automated Statements

Save time and reduce errors with automated investor statements, discharge statements, and financial reporting at the click of a button.

- Investor Statements

- Discharge Calculations

- Financial Reports

Digital Data Rooms

Securely share documents with investors and stakeholders through our integrated, permission-controlled data rooms with full audit tracking.

- Secure Document Sharing

- Access Permissions

- Audit Trails & Logs

White-Label Solutions

Deliver a seamless experience to your investors with a fully branded, white-label version of Monergise—your brand, our technology.

- Custom Branding

- Investor Portals

- Branded Reports & Documents

Automated Communications

Keep investors informed and engaged with automated deal teasers, email campaigns, and milestone notifications directly from the platform.

- Investor Deal Teasers

- Automated Email Campaigns

- Event & Milestone Alerts

Consultation Form

Ready to Transform Your Lending Operations?

Discover how Monergise can simplify your private lending processes, improve investor management, and automate critical workflows—allowing you to focus on growing your business.

Schedule a Free Consultation

Complete the form below and one of our platform specialists will reach out within 24 hours.

Why Choose Monergise

Transform Your Private Lending Operations

Monergise delivers an end-to-end digital solution that simplifies your private lending workflows, improves compliance, and enhances the investor experience.

From deal origination to investor onboarding and automated reporting, we help you focus on growing your business while our platform handles the heavy lifting behind the scenes.

Built by Industry Experts

Designed by experienced Australian private lenders who understand the real challenges of the market and what it takes to succeed.

Data-Driven Decision Making

Leverage insightful reporting, real-time dashboards, and automated financial summaries to make confident lending decisions faster.

Accelerated Deal Cycles

With automated KYC, investor onboarding, and document generation, close deals faster and reduce administrative overhead.

Compliance & Security Guaranteed

Stay compliant with built-in KYC verification and secure document sharing through permission-controlled data rooms.

Our Pricing Plans

These rates are exclusive early adopter prices for those joining our platform now. While future pricing is yet to be confirmed, early adopters benefit from substantial discounts during this initial launch period

Fundraiser

Up to 10 users under your company account

- Access to Investor Network

- Deal Listing

- Loan Management

- Custom Fee Calculation

- Automated Payments

- Investor CRM

- Data Room

- Automated KYC

Loan Manager

Up to 10 users under your company account

- Loan Management for External Deals

- Custom Fee Calculation

- Investor CRM

- Automated Payments

- Report Generation

- Document Management

- Automated Statements

Fundraiser & Loan Manager

Up to 10 users under your company account

- Access to Investor Network

- Loan Management

- Custom Fee Calculation

- Automated Payments

- Investor CRM

- Data Room

- Automated KYC

- Report Generation

Loan Manager Pro

Up to 10 users under your company account

- Advanced Lead Generation

- Complete Loan & Deal Management

- Brokers CRM

- Custom Landing Pages

- SEO & Marketing Support

- Complete Automation

Need a custom solution? Contact us for a personalized quote.

Frequently Asked Questions

How does Monergise simplify private lending operations?

Monergise automates key lending workflows such as investor onboarding, KYC compliance, deal management, and financial reporting. This helps reduce manual errors and accelerates deal cycles, all while ensuring compliance and security.

Can I use Monergise under my own brand?

Yes! With our white-label solution, you can fully brand the platform to match your business identity. Your investors and clients will experience a seamless, branded interface without seeing the Monergise name.

Does Monergise handle compliance and KYC verification?

Absolutely. Monergise includes built-in KYC and AML compliance for Individuals, Companies, SMSFs, and Trusts. Our automated workflows ensure regulatory compliance without slowing down your onboarding process.

Can I integrate Monergise with my existing CRM or financial tools?

Yes, Monergise offers API integrations that allow you to connect with CRMs, financial platforms, and accounting software like Xero. We help ensure a smooth data flow across your business tools.

What kind of reporting and analytics does Monergise provide?

Monergise offers real-time dashboards, investor reporting, automated financial summaries, and discharge statement generation. You’ll have full visibility over deal performance and investor activity at all times.

Still have questions?

Our team is here to help. If you can’t find the answers you’re looking for, reach out and we’ll be happy to guide you through the Monergise platform.

Contact UsContact

Contact Information

Have questions about Monergise or want to request a demo? Reach out to us and our team will respond promptly.

Email:

hello@monergise.com.au

Phone:

1300 247 536